Will the Fed be able to reduce the balance sheet? We think – NOT!!!

Last week many economists adjusted their Fed call to expect 3-4 hikes this year with liftoff in March, and they expected quantitative tightening to start during the summer.

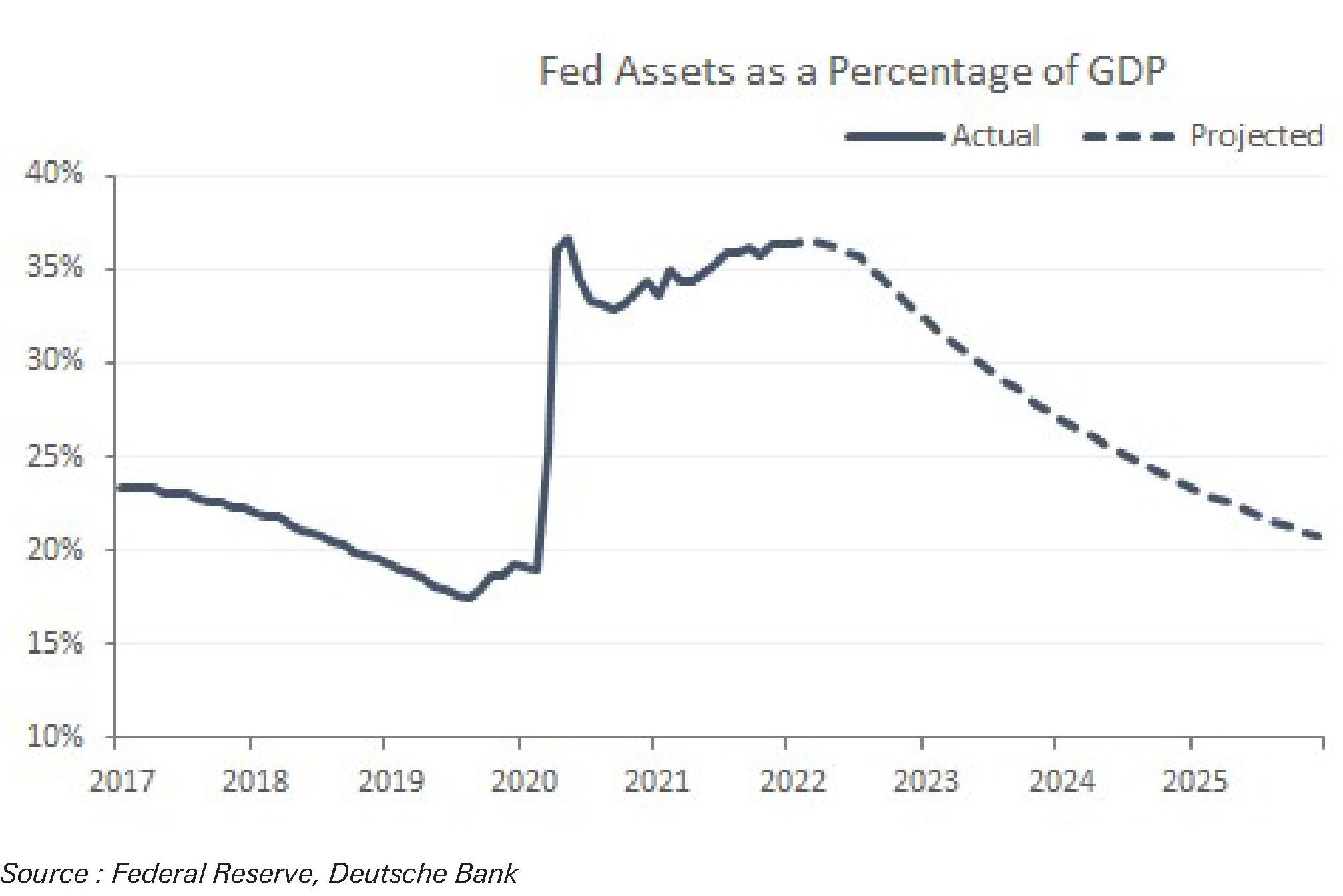

Deutsche Bank analysts assume that the Fed balance sheet would peak just under $9tn after QE completes in March, before falling back to eventually approach 20% of GDP from over 35% today, and around a third smaller than this peak. That’s a level more consistent with the pre-covid experience and a potential target highlighted by Governor Waller. Under this projection, the balance sheet would reduce by $560bn this year and $1tn in 2023. For context, between October 2017 and August 2019, QT reduced the balance sheet by around $700bn from c.$4.47tn to $3.76tn.

The core assumption is that a $650-700bn drawdown equates to around a 25bps hike so out to end 2023, the reduction will be equal to c.2.5 hikes.

Will the Fed be able to reduce the balance sheet? We think – NOT!!!

Our view is that the balance sheet will have to grow substantially again in the years ahead as the authorities are forced to use financial repression in order to make the growing public debt burden sustainable. Uncontrollable money printing for the foreseeable future is the only remedy that Fed will use. 2018 was evidence that reducing liquidity eventually bites, when 90%+ of major asset classes delivered negative performance in USD terms. The Fed then had the luxury of a dovish pivot as inflation trended back down towards and below 2%. They do not have this option today.

Fed assets/GDP could decline to its pre-covid level by the end of 2025