Chinese Tech Stocks will be the source of alpha in the global equities' portfolio in 2022-2023

Severe regulatory and investment headwinds led to sector underperformance in 2021. While consumer internet may see decelerating growth, industrial internet has entered a hyper-growth phase as the 5G rollout is complete. China’s public cloud could quadruple in five years with rising IT spending, especially in automation and data analytics. China will also lead the autonomous driving deployment globally, likely hitting an inflection point by 2025.

Monetary easing will support the Chinese equities in 2022-2023. After a 10 bps MLF policy rate cut on Jan 17, 2022, the PBOC sent strong signals of further monetary easing at a press conference the next day. We expect another 10bps MLF rate cut before end-April. The likelihood of a 50bps RRR cut has also increased. Credit growth will likely accelerate in Q1, supported by PBOC’s lending facilities.

The PBOC’s recent moves further confirmed that China’s macro policy stance had shifted decisively since the annual economic meeting in December. If policy announcements are not sufficient to turn market sentiment, economic data points in the coming months, such as higher credit growth and fixed asset investment rebound, will likely help investors to finally regain their confidence in the Chinese economy.

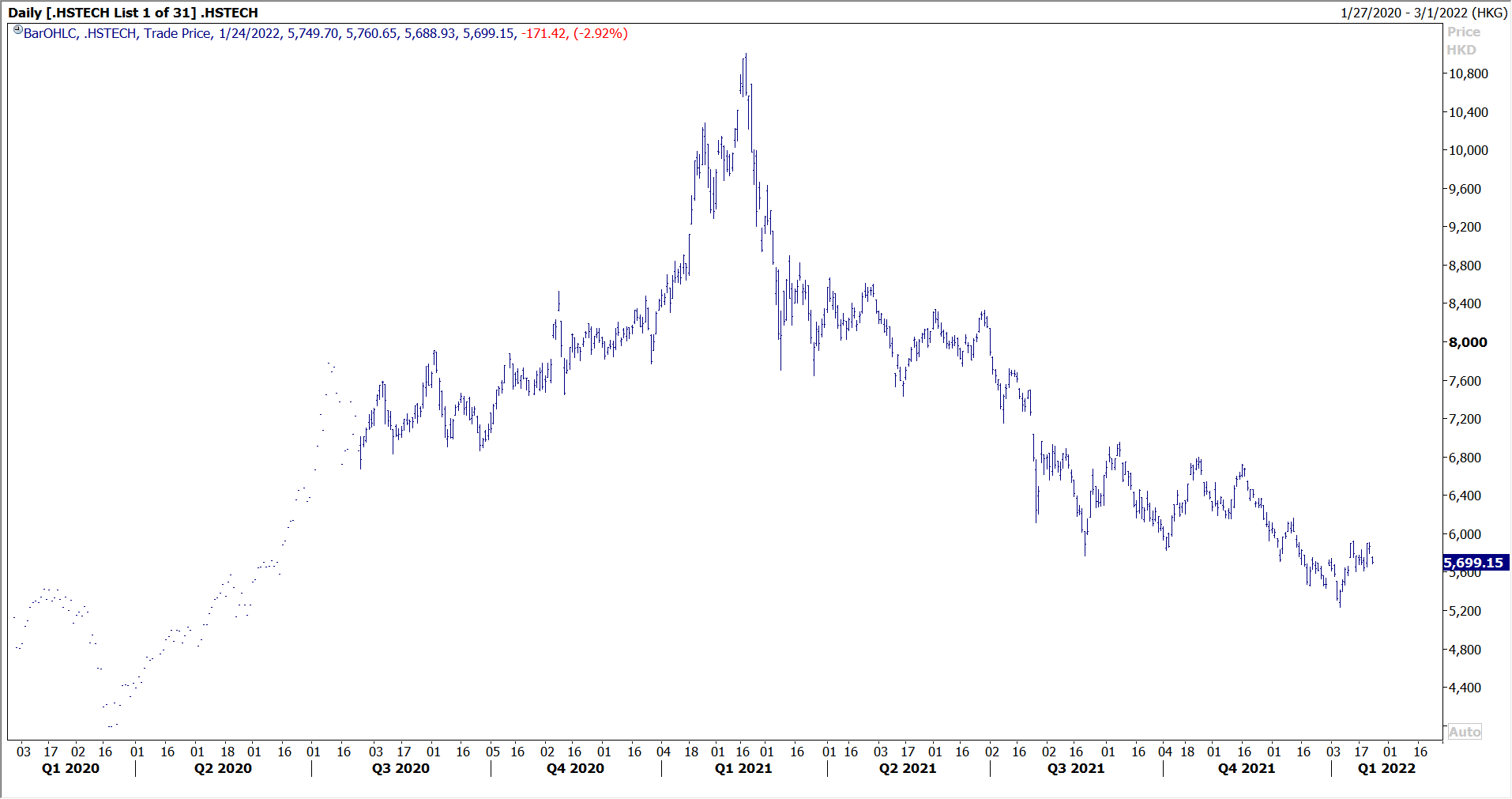

Hang Seng Tech Index